Own Gold Like It’s Still The Wild, Wild West.

WE HIT DIFFERENT.

Cover Your Ass-ets With a GOLD iRA.

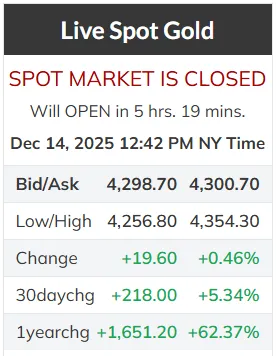

Gold IRAs: Up 27% (2024), 62% (2025), 118% (5 yrs), 258% (6 yrs).

Banks, Wall Street, and your advisor? They'll hate it.

Your ass-ets? Covered.

Call for how it works. No sales. (800) 637‑7886.

15000+ Client Trust Us

Get a Free Consultation + IRA Guide

Learn how precious metals can safeguard your retirement. Fill out the form to receive your complimentary guide.

THE 401(K) gOLD gROUP DIFFERENCE.

Central Banks and billionaires HIT DIFFERENT.

Our clients’ GOLD IRAs Up 258% in 6 years HIT DIFFERENT.

WE HIT DIFFERENT.

MIC DROP.

So, the question is not whether your retirement account will survive inflation at 40%.

The question is what are you going to do about it now that you know it can not and will not?

We do not provide financial advice. Past performance is not a guarantee of future results.

No Games. Just Gold At 5% Over Our Cost.

How We Actually Get Paid (And Why It Matters To You).

We keep it simple: IRS‑approved gold and silver for your IRA at 5% over our cost. No mystery fees, no surprise “spreads."

No salespeople. No influencers, Senators, or celebrities to pay. Those endorsements aren’t free. You pay for them in higher metal prices.

We’ve skipped these clowns since 2012, so we don’t have to jack up your price. It’s still 5% above our cost.

Cover your ass‑ets .

Benefits of Precious Metals IRAs

1. Gold IRAs grew by 27% in 2024.

2. Gold IRAs increased 60% in 2025.

3. Gold IRAs increased from $1,900 Jan, 2023 to $4,300 in Dec, 2025 (a 118% increase).

4. Over the last 6 years, gold has shown cumulative gains roughly 258%.

Downside Resilience

Often behaves differently during market stress.

Inflation Hedge

Metals have historically helped preserve purchasing power over long periods.

Physical Asset

Held and stored through approved custodians/depositories.

Transparent Costs

Clear pricing and fee explanation up front.

Liquidity Options

We offer first right to buy back your precious metals.

Diversification

Reduce reliance on stocks and bonds alone.

Disclaimer: Historical performance is not indicative of future results. Figures are approximate and based on publicly available market data.

What We Do

How a Precious Metals IRA Rollover Works.

Opening a Precious Metals IRA allows you to use physical gold, silver, and other metals to preserve the value of the money you’ve spent your entire life saving. It’s a tax-deferred way to add long-term growth and stability to your retirement strategy.

Step 1 – Allocate Funds

1. Decide How Much to Protect.

On a brief call, we look at your current 401(k)/IRA, your age, and decide what portion makes

sense to move into metals. You’re in control. No pressure.

Step 2 – Paperwork

2. We Handle the Heavy Paperwork.

We coordinate with an IRS‑approved custodian to open your self‑directed IRA and request the rollover/transfer. Typical completion time: 4 - 6 weeks, depending on your current custodian.

Step 3 – Delivery & Storage

. We Handle the Heavy Paperwork.

We coordinate with an IRS‑approved custodian to open your self‑directed IRA and request the rollover/transfer. Typical completion time: 4 - 6 weeks, depending on your current custodian.

Step 4 – Confirmations

4. Delivery Confirmation

Once your metals are securely delivered to an insured depository account in your name (tracking numbers provided to you prior to delivery), you will receive final delivery confirmations and ongoing statements. You can also track on your own.

WHO WE ARE

401(k) Gold Group. Founded In 2012.

We have 15,000+ clients since 2012, who secured their retirement with precious metals IRAs. Plus, $350 million under management.

Zero lawsuits in 14 Yrs!

Typical transfers time completion: 4 - 6 weeks.

What if I need to talk to my spouse, my advisor… or “think about it”?

Spouse

What if my spouse needs to be involved?

If your spouse is part of the decision, both of you should be on the consultation call.

This isn’t a sales pitch. We’re not here to “close” anyone. On the call, we’ll:

Explain how a Gold IRA actually works

Walk through the real numbers (27% last year, ~60% this year, ~258% over 6 years)

Show how gold can help protect what you’ve already built

Answer questions so you can decide together, like adults

If your spouse matters in this decision, bring them on from the start so you both hear the same facts at the same time.

Advisor/Accountant

What about my accountant or financial advisor?

Just be honest with yourself:

Gold is up around 258% in 6 years.

They kept you paying fees on underperforming accounts.

They knew about gold's growth and never suggested it to you. Why?

When a financial advisor watches gold climb 258% and never picks up the phone, they aren’t protecting you. They are protecting their fees.

Better order:

Get the facts from us on how a Gold IRA works; risks, fees, options.

Then, if you want, show those facts to your accountant or advisor and see what they say.

We’re not here to replace your judgment. Just to make sure you’re not in the dark.

Our Transparent Business Model

Our No-Games Promise

Did we mention we get financial advisors fired?

We help you cover your ass‑ets with Gold & Silver IRAs.

No games. No sales tactics. No salespeople.

Just gold at a flat 5% over our cost since 2012.

No clownbrities or celebriclowns to jack your price 30-40%.

Zero lawsuits. No purchased reviews.

Just the lowest honest pricing we can give you, every single time.

Educate Yourself

Secure your future with customized retirement strategies and income planning.gold and silver IRAs.

Beat Inflation

Protect your wealth from the ravages of Wall Street's bad decisions that affect your funds negatively.

Risk Assessment

Protect your retirement with smart tangible assets in gold that will not vanish after a market crash.

401(k) Gold Group, Inc. does not provide investment or tax advice. Precious metals are speculative purchases and involve substantial risks. Past performance is no indication or guarantee of future performance or returns. A minimum purchase applies. Market prices are volatile and unpredictable and may rise and fall over time. Before making a purchase, you should consult your advisors.

© 2025. 401(k) Gold Group, Inc. - All Rights Reserved.